I know it doesn’t feel like it now, but this is housing hope for south Kentucky.

The phrase, “Good fences make good neighbors” has often been used modernly to talk about six-foot subdivision fences that keep everyone out of your business, however, that’s not the origin of the saying.

And old England/Scotland/Wales don’t notice those low-lying stone fences that realistically ride more boundary than anything else because they are so short. What would happen, generally, is that neighbors would routinely walk the property line to make sure everything was okay, however, if they saw that the fence was in disrepair, whoever saw it would fix it. No question of whose responsibility it was, who’s fault it was or if it was your job.

If you saw something that needs help, you just do it – that is a cultural value we still have in South Kentucky today.

The beginning of December was devastating for so many in our beautiful state, but my heart hurt for my home, your home – Bowling Green. Some neighborhoods are completely gone, and some have lost so much more than a house – your family has suffered great loss. I wish I had the words to heal, to help more or to restore, but that power is far above my abilities. What I do have the ability to do is to rebuild, restore and improve housing. So please accept this contribution to your families’ future goals. The Federal Housing Administration offers a product that does just that – in section 203H.

203H loans help those whose homes have been damaged due to natural disasters. Notice, I said “home,” not “house.” Whether it was the home you had been living in or that you were in the process of buying, or even renting, you now qualify for some amazing assistance. $0 down home ownership, with little pain.

“So how does it work? What’s the catch?”

Wonderful questions! First off, there is no catch. Your area has been declared in a State of Emergency and your home was destroyed or damaged. It works the same as buying or refinancing your home with the exception of it being classified as damaged or destroyed by a natural disaster. This classification allows you to be eligible for the program to have 100% financing – meaning there is no down payment. Closing costs will still need to be paid either out-of-pocket, by the seller, or through lender credit. FHA mortgage insurance is still included in your payments as if you were using any other loan product besides a 20% down payment with conventional. From start to finish, the process for a borrower would be the same as going through any other loan product. Within a year from when the state of emergency was declared for your area (12/12/21), you must apply for this loan. After those 12 months are up, we would have to talk about other financing options.

“What if we were renting our place?”

Another wonderful question. Now let’s talk about your eligibility. If you are wanting to purchase instead of going back into another rental, you have access to this program. Qualifications are simple: aside from meeting the credit and financial criteria, you have to provide evidence that your previous residence was destroyed or damaged by the disaster in the area of the federally declared State of Emergency. Also, because you have a year, there’s a good chance we can help clean up your credit, if needed, and still get you qualified.

“What if I need repair and not replacement?”

We can help with that as well. Many people can come into these types of situations to take advantage of those in crisis. Funds only come once, so having quality people goes a long way – we don’t want six months to go by and you’re needing to replace things that have just been repaired. Reaching out to local companies who have always been in the community and trusted to do quality work is a good option. Not saying companies outside the area are bad choices, but in the process of rebuilding your home, others around you are also rebuilding their lives.

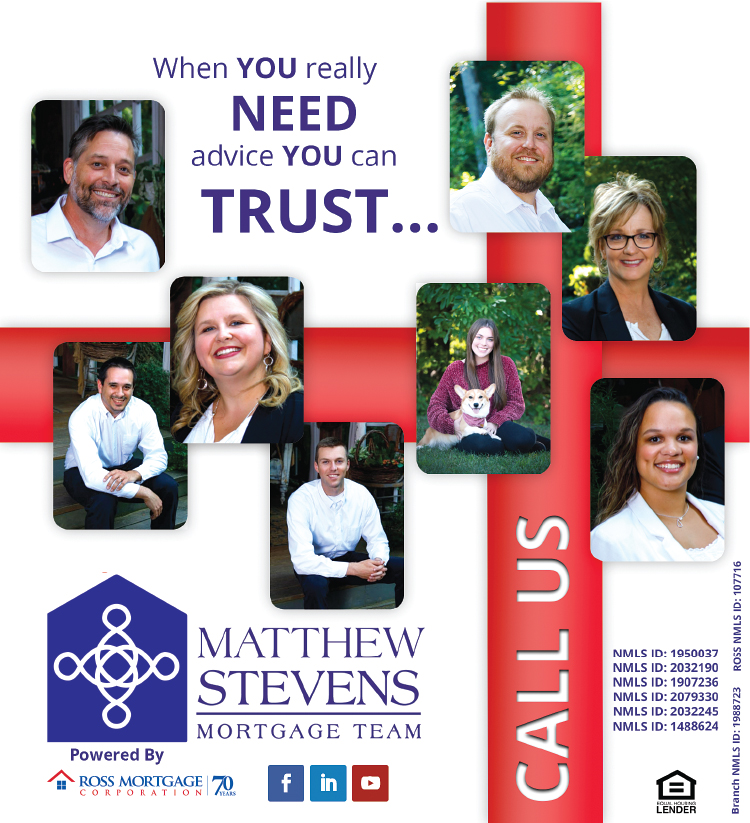

Let me and my team help you rebuild your old Kentucky home. My name is Taiya Bagby, I am a Mortgage Loan Originator with The Matthew Stevens Team powered by Ross Mortgage Corporation. Lean on me for support to answer your mortgage loan questions and help you through the process from beginning to end. Call me at 270-772-2038 or email me at tbagby@rossmortgage.com.

-by Matthew Stevens and Taiya Bagby